In honor of Asian Pacific American Heritage Month, we’re featuring profiles and interviews with members of our Haas community.

Prof. Xiao-Jun Zhang moved to the U.S. for love, and stayed because he built a family and a career here.

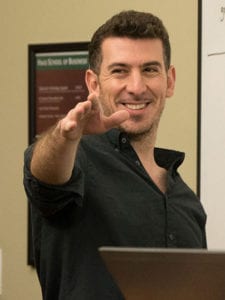

Prof. Xiao-Jun Zhang holding a “Berkeley Haas Culture Champion” pin, worn by those to help to advance the school’s culture.

Since he joined the Haas Accounting Group in 1998, Zhang has become a much-loved professor, opening the minds of generations of students to accounting—even those who start out thinking it’s boring. He twice won the Cheit Award for Excellence in Teaching in the Evening & Weekend MBA program, and last year he made Poets & Quants’ list of the favorite professors of executive MBA students.

Zhang shared how his his life has been a “fate-guided series of decisions,” and how his cultural perspective influences the way he runs his classes in a very intentional way.

Where were you born and where did you grow up?

I was born and raised in Beijing, China. I went to primary school, high school, and college all in Beijing.

When did you move to the U.S., and why?

I moved to the U.S. in 1992 and the reason was simple: My wife—who was then my girlfriend—transferred to Mount Holyoke College in Massachusetts, so I decided to follow her to the U.S.

Did you think you’d stay here?

I was young then and didn’t think too much about my long-term plans, including whether to stay in the U.S. or not after graduation. The end result of staying here was more of a fate-guided series of decisions, driven by family more than a deliberate career path.

How did you come to Berkeley?

At the time, I was choosing between several schools—including Berkeley, Chicago, Yale, and Duke. What made Berkeley stand out was my research area of financial statement analysis. My advisor, James Ohlson, had worked here, and my frequent co-author, Steve Penman, was here at that time. From the research collaboration perspective, Berkeley was a natural fit. Also, my wife really wanted to live in the Bay Area.

Was there anything about Berkeley’s culture that attracted you?

If you look around the country, I would characterize Berkeley as of one of the most open-minded places. There’s a strong emphasis on equality, on judging people based on what he or she can contribute, rather than more superficial aspects. For people of Asian origin, feeling that sense of fairness is important. I would choose to work among colleagues who share that same sense of equality and fairness.

Having grown up in China, do you feel like you have a different perspective—as an academic and a teacher—than your American-born colleagues?

I would say so. The way you grew up shapes you consciously and unconsciously in so many ways. I’ll give you an example. In the classroom, I find it easier to understand certain student behaviors, especially with students from Asian countries. In the classroom in China, all we were supposed to do was take notes and memorize what we were told. You’re not supposed to ask questions. I suppose there’s similar cultures in Japan, Korea, and other Asian countries. When you teach graduate classes at Berkeley, you notice students from those cultures tend to be more reserved. I tend to be understanding, and when I design my class, I try to create a very relaxing environment without a lot of pressure to participate. It’s really rewarding when you see these students gradually warm up, and at the end of the semester they are as active as the others.

So do you put less emphasis on participation in their grades?

I put as much emphasis on participation, but I redefine it. I don’t count the number of questions they ask. To me, whether a student has been following the class is the most important thing. I tell the students that, after so many years of teaching, I know just by looking at your eyes whether you’re following the class. Once you take that pressure off, students start to participate in a natural way, rather than trying to think of a question just to ask a question.

That’s so interesting. There’s a lot of discussion around Haas and at business schools about inclusion. People have noticed that men often dominate classroom conversations and are working on changing that culture. Do you find that women tend to speak up more in your classes because of the atmosphere you create?

I don’t pay attention to whether it’s a man versus a woman, but I do tell students, “You may notice sometimes you raise your hand but you don’t get called on. Don’t take it personally, but I want to give priority to whoever hasn’t spoken so far.” Most of the students have no problem with that. Once you tell them, “Your role is just keep raising your hand,” they are likely to continue doing it but they can relax.

You’re a well-loved teacher—you’ve won the Cheit Award twice, and last year you were on Poets & Quants list of favorite exec MBA students. What do you like about teaching accounting?

I like helping them realize that accounting is not just a bunch of rules. Accounting is a way of thinking, in the sense that it’s looking at a business from the financial perspective. You can have all these fancy business plans, but in the end, you’re going to be measured by how the financial aspect works out. When students realize they need to learn this to operate in real life they get excited. Most rewarding is when you see the light bulb go on, and they see that accounting is not boring and it can actually be exciting. Then you just leave the rest to them. They will learn it all by themselves. At the end of the day, they give you credit for what they’ve learned, and they start liking you.

So from that perspective, you don’t have to teach them much beyond the first week?

In some sense yes. Once you help them realize what accounting really is, they will do all the work and teach themselves.

Can you share an example of your recent research?

In finance and accounting there is the book-to-market ratio phenomenon. Basically, people find that the book value (or accounting value) divided by the market capitalization somehow correlates with future stock returns. People got very excited about this idea because it seems they could make money off it. From the academic perspective, the question is why? I think part of the reason has to do with accounting, in the sense that the book value tends to reflect a stock’s downside risk due to the conservatism-bias in accounting. As a result, the book-to-market ratio reflects a stock’s upside potential relative to its downside risk. Another ingredient to this phenomenon is investors’ preference for “positive skewness” in stock returns: In other words, when you make an investment and receive huge return from it, you get a disproportionately high degree of satisfaction. Now you can brag about it at dinner parties, for instance. Maybe the other nine of your ten stocks don’t do well, but that doesn’t seem matter as much. Putting these two ingredients together, we start to see why investors like stocks with a low probability of huge upside potential, which leads them to prefer the so-called growth stocks.

That sounds like almost like a behavioral finance perspective. Is it rational to put faith in a low probability of a high return over a more certain, smaller return?

I would say yes, because these investors get significant happiness from this one big return. The same reasoning underlies people’s preference for gambling. Going after things that make you happy is rational. Trying to understand human behavior and what really gives humans happiness—or what they call in economics “utility”—is quite complicated and quite fascinating to dive into.

Do ever think you’d move back to China?

I don’t see any reason why I’d want to go somewhere else. I couldn’t ask for a better academic environment than Berkeley, in terms of freedom of thinking. Also my family loves living here. Your home is where your family is. I go to Beijing from time to time, but the Beijing of today is completely different from the city I grew up in. The hometown I grew up in will just be in my memory forever.

The post Prof. Xiao-Jun Zhang’s intentional teaching appeared first on Haas News | Berkeley Haas.

Senior Lecturer Holly Schroth was motivated by her recent experiences in the classroom to research and write “

Senior Lecturer Holly Schroth was motivated by her recent experiences in the classroom to research and write “